Business

6 min

The year 2020 almost started with unprecedented chaos all over the globe because of the COVID-19 virus. Now, it's the month of June, and we're still seeing the increase in its entropy!!

By Quokkalabs LLP

09 Jun, 2020

The coming era will be all about various 'New Normals.

Technology and the increase in population and demands are pushing humans to search for ways to have easy, safe, and comfortable lives.

Thus, "if consumer companies seek to thrive into the future, they must adapt to new business models to quickly transform challenges into opportunities. Digital Transformation is one of many business models that will be adequate to help the FMCG market grow like never before!!"

Now, before jumping right into everything, let's see what this article includes for you:

You use soap, detergents, grains, food, beverages, hair oils, shampoos, other packaged food, juices, etc. They all fall under the category of Fast Moving Consumer Goods or FMCGs. These products are short shelf life. Because of their regular use, they are always in high demand. The market that deals with them is known as the FMCG market.

After ruling the micro-product industry for over half a century, the FMCG -fast-moving consumer goods - market is experiencing significant hurdles in keeping up with the extensive market share that it has been holding onto.

Digital marketing, e-commerce platforms, and automated productions are catalysts for scaling up the FMCG bulk to meet the latest trends.

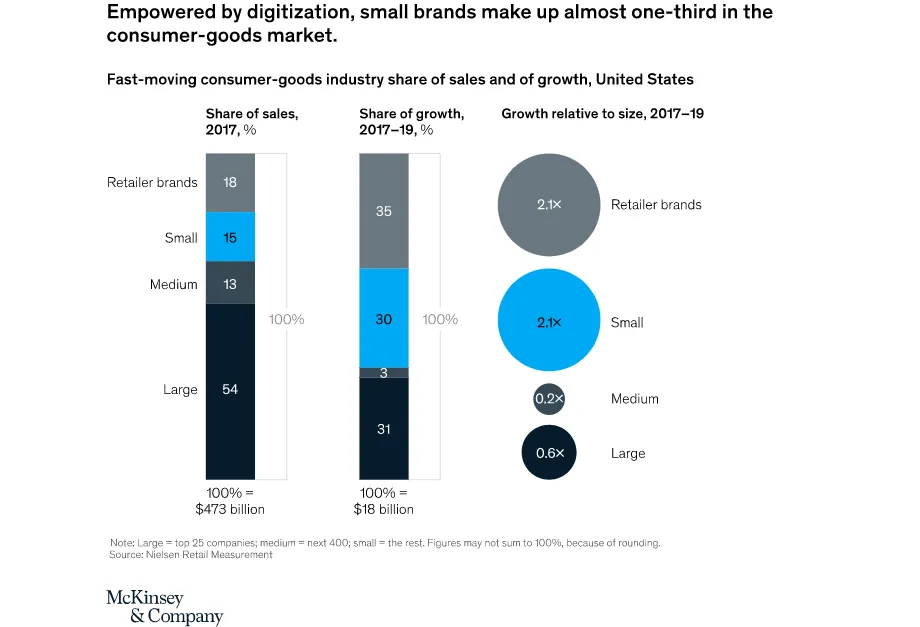

The small and medium-scale manufacturers (SMEs/SMBs), which are strictly limited to retailers and grocery stores, face stiff competition from cheaper goods manufactured by local brands sold online through global brands like Amazon, etc.

Also, the prominent manufacturers, having yet to cultivate their brand value in the consumer market, are facing severe hurdles from branded market giants who rapidly encash digital transformation to gain brand recognition and visibility, resulting in more acceptance in the market.

Post World War 2, there are now 23 FMCG companies in the top 100 manufacturing giants in the world, maintaining an annual 15% TRS (Total Return to Shareholders), thus actively attracting investments for 45 long years. For example, P&G is one of them.

However, this journey has been hitting rough patches due to increased competition, exploding local brands, stocking-up issues, and other parameters.

Let's see how digital networking and mobility can help gain momentum in the FMCG market.

Too many product launches in the FMCG market have threatened the brand value of the companies as, according to Nielson's study, only 0.2% of the new products gain influence among consumers. It can be visualized by the fact that out of 14,509 FMCG products launched in India, only 31 have been able to make their mark in the Rs. 2 lakh crore business.

The new buyers are living better lifestyles and prefer branded products more.

This declining growth rate is evidence that millennial consumption behavior is changing towards more branded products, i.e., the companies enjoying brand visibility are taking on the FMCG market.

FMCG giants - Johnson & Johnson, Hindustan Unilever, Himalaya, Lakmé, ITC, Godrej, P&G, and other companies that have dominated the FMCG market in India for decades are now competing with D2C-focused/Direct-to-customer business models.

If you go into detail about how much time market giants Revlon and Lotus took, they took around 20 years to reach USD 13.4 million revenue mark. In contrast, new startups take less time to surpass this mark. For example, Mamaearth reached this milestone in just four years of span.

How? And what technology or strategy helps?

The answer is robust digital marketing and transformation to attract potential buyers and make them believe Mamaearth is better than J&J and others!

Moreover, companies with dedicated websites register an 88% Year-on-Year rise in consumer demand. Following this, more businesses are adopting the D2C model. In India alone, more than 800 D2C brands are looking to reach USD 101 billion by 2025.

With the help of online product delivery companies like Amazon and Flipkart, the FMCG market is looking at new milestones to achieve.

Furthermore, in the era of OTTs and smartphones, advertising volumes on television still record healthy growth. And companies in the FMCG market continue to maintain their leadership position with significant growth in ad volumes, and even the e-commerce sector is showing healthy growth.

Thus, bringing the products live on websites, television, and mobile apps encourages online search and purchase. It is how you can improve your brand visibility among your consumers and potential buyers.

Marketing your products and services on mobile apps, websites, and television gives you an extra channel to sell and brings your brand closer to your customers, influencing brand recognition quickly.

FMCG product sales are mostly limited to grocery and retail stores, which only experience physical visibility. Instead of transporting bulk goods for sales, e-commerce platforms facilitate demand-based transportation, helping reduce delivery costs.

Such e-commerce platforms such as Meesho, Flipkart, Amazon, and Big Basket employ omnichannel trade, enhancing market presence and brand visibility, giving you an upper hand against local products that seldom sell online.

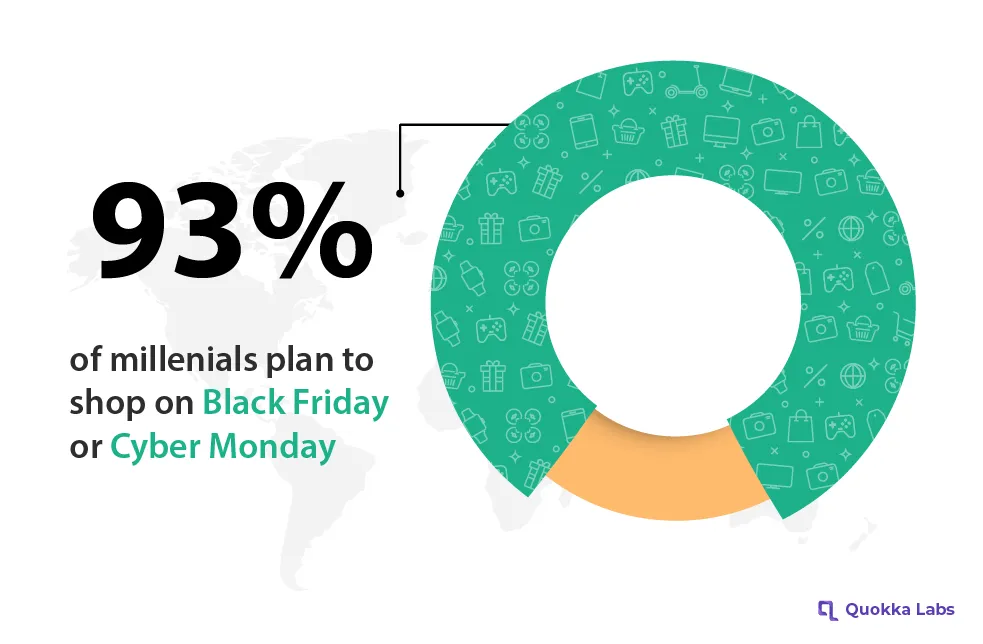

The 21-36 age group buyers are becoming more value-conscious: a byproduct of an evolving lifestyle. Hence, this is the right time to capitalize on digital disruptions and increase your brand recognition among the urban consumers who have been the main driving force of the FMCG market.

Traditional manufacturing pipelines stress a company's goal of increasing production at lower costs to survive in the market.

In 2011, Harvard Business Review agreed that the adaptability of key market players to automation and robotic technology is necessary.

Manual transportation often relies on on-paper statistics that aren't updated in real-time and are prone to multiple errors.

Thus, heavy reliance on offline trading channels has decreased profit margins:

"FMCG companies' growth in TRS lagged the S &P 500 by three percentage points from 2012 to 2017."

Consumer behavior has changed drastically with large-scale digital disruptions facilitated by internet penetration post-2017. While consumers shopping on e-commerce platforms focus more on brand value, grocery stores prioritize cost over the brand.

In both cases, FMCG companies are losing out due to non-existent brand recognition or declining profit in cheaper goods competition.

Mobile apps and websites give you an augmented analysis of organic visits, click-through rates, conversion ratio, etc., helping you with data to understand real-time purchasing behavior at the consumer level.

You can develop metrics-based sales strategies to meet your profit goals in this highly competitive market.

In a survey of retail industry leaders, nearly 40 percent said millennials' lack of loyalty is their #1 concern. It reflects that Millennials today are about 9% poorer than the last generation.

It pushes companies to devise a more customer-centric approach, possible only through digital adaptation. Trading in bulk makes your product vulnerable to price fluctuations locally and globally. Allowing customization wins you loyal users who will continue buying from you for a lifetime.

Pampers coined points as a reward feature for many purchases.

Pampers coined points as a reward feature for many purchases.

We found that 95 percent or more of millennials say they want their brands to court them actively, and coupons sent via email or mailed to their homes currently (or will) influence them most - Accenture.

Online availability of products enables you to dictate sales according to time and place more efficiently. Relying on the retailer's feedback on product demands makes inventory management cumbersome, failing to tailor your sales to the local market.

Digital media can also generate immediate demands by announcing flash sales when you identify sluggish selling of one or more products. In such cases, online availability can quickly connect you with interested customers: avoiding stock pile-ups and encouraging brand value.

Chatbots are so popular because speed is always part of the equation when people want an answer!

Instead of relying on the selling capability of a retailer to market your product, it is always better to answer your customer queries directly within seconds!

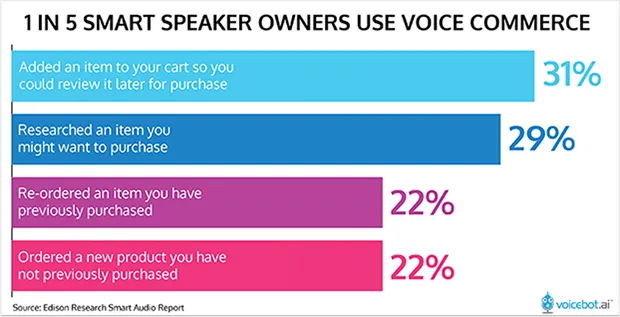

Voice assistants and intelligent speakers are gaining attention now, with over 20% of Google searches done here. Also, by 2020, the number of smart speakers will be 21.4 million. And people are doing more than just Google searches on these!!

22% of smart speakers in the US have bought something online using their speakers.

Social presence is now considered a necessity to survive in any market. You can't afford to let your product get forgotten among the buyers after giving lucrative discounts to generate more sales.

The biggest FMCG company and beverage leader, Coca-Cola, often carries out all its customer-centric campaigns on its social media handles, having millions of followers.

Digital marketing gives you several options to explore for enhancing customer interaction to remain in the spotlight 24*7.

Besides social media, email marketing can give brands an average return on investment (ROI) of 122%, a channel that the top 100 UK FMCG brands overlook in Kagool's FMCG Digital Census.

Colgate has been one of the cornerstones of FMCG's growth. It has been actively adopting digitization and mobility in managing its entire processing from inventory to automated guided vehicles (AGVs) in its production chain.

Director of Factory Performance and Reliability for Colgate-Palmolive, Andres Bejarano, emphasized, "The idea is to automate everything that can automate!"

Already ranking #9 on Gartner's Supply Chain Top 25 for 2019, Colgate has introduced complete automation in its manufacturing and supply chains:

After achieving such sophistication in its supply chain, Colgate is now targeting to take its digital initiatives to the customers like its peer Nestle's app can check the freshness of any Nestle food products.

The eight determinants of success mentioned above can become pillars for every successful digital transformation. Many companies and organizations are already up for them and applying them to recover and thrive more!

However, a few factors need to be more noticeable and often not overlooked - the human element.

Based on McKinsey's recent studies, about 33 % of all transformations fail due to the lack of support from management. In short, leaders should come forward to drive fundamental change actively!! Very rare to see it these days!

Moreover, since humans are highly emotional, a transformation is a huge emotional challenge. So if a shift is on the verge of failing, it's probably because of the resistance from a few humans. But guess what? The change is invertible. Either change or the time will make changes accordingly!! And when it happens, most people don't like it.

Thus, organizations seek to establish an emotional connection with consumers, employees, and stakeholders by motivating them and tailoring their approach to accepting the change. Compelling marketing stories and visuals that resonate with consumers and employees can help overcome digital barriers.

Consumer goods/FMCG manufacturers can follow the most successful organizations to leverage operating models to meet today's market demands. It can shape your business for the future by increasing scalability and flexibility and reducing the gap between your products and services and customers/consumers.

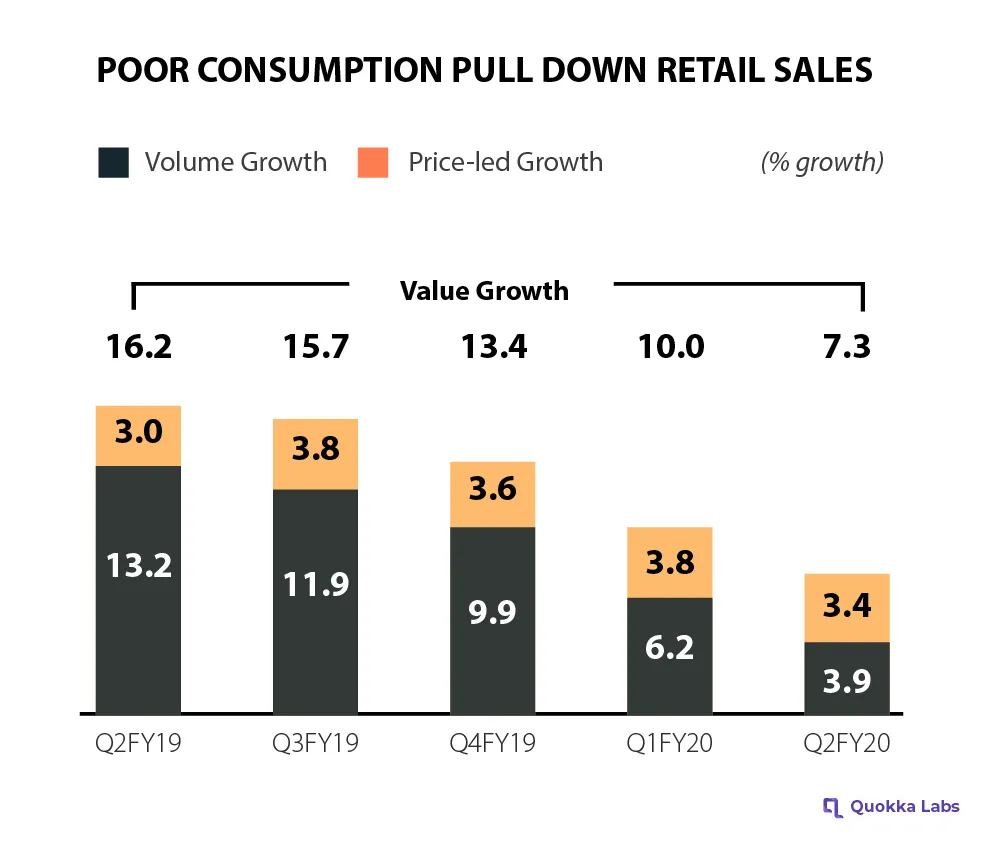

The tapered growth rate among FMCG companies is increasing their profits. Most of the revenue generated now is from volume growth rather than price-led growth, which means its GDP contribution is reducing yearly.

Looking at the fractures in FMCG growth, marketers should take some bold steps in revising their existing workflows with automation and digitization, from inventory management and production to leveraging brand recognition and people-friendly customer service.

What Is a Push Notification and Why It Matters for Your App Strategy

By Dhruv Joshi

5 min read

Top React Native Development Companies to Build Scalable Apps

By Dhruv Joshi

5 min read

How Wearable Technology Is Driving Real-Time Data Experiences in Mobile Apps

By Sannidhya Sharma

5 min read

How to Use Augmented Reality in Retail to Boost Customer Engagement and Sales

By Sannidhya Sharma

5 min read

Business

5 min

What is a push notification and how does it boost app engagement? Learn the best practices, examples, and strategies for using push notifications effectively in your mobile app. Drive retention, re-engage users, and improve ROI with smart, timely alerts.

Business

5 min

Looking for the best React Native app development companies in 2025? This expert guide highlights the top 10 agencies trusted for building scalable, user-friendly, and cross-platform mobile apps. Learn how to choose the right partner, explore key services, compare pricing, and discover what makes each company stand out in today’s fast-growing mobile market.

Business

5 min

Let’s explore how augmented reality is reshaping accounting apps—from static spreadsheets to immersive, interactive experiences. This blog dives into real-world use cases, UX benefits, and how fintech teams can build smarter, user-first financial tools with AR.

Feeling lost!! Book a slot and get answers to all your industry-relevant doubts