Industry news

4 min

Discover how FinTech drives a revolution in the finance industry, from disrupting traditional banking to introducing innovative financial products and services. Explore the impact of technology on finance and stay ahead of the curve.

By Quokkalabs LLP

22 Jul, 2020

Financial Technology, often referred to as FinTech, is reshaping how Financial Services are offered. There has been considerable improvement & ease while availing Financial services now.

We can easily send money to our friends and family via PayPal, PayTM, or Google Pay in a few clicks; Small Businesses can now process business transactions with ease, and a cheque can be directly deposited within minutes via Mobile Banking Apps - Click a photo & deposit, you don't have to go all the way to the Bank.

This is "FinTech," tech transformations in the Finance industry & it is just the beginning.

Many FinTech companies are advancing with innovative and technological solutions in areas such as online and mobile payments, big data analytics, alternative finance, investing, financial management & other operations involved in the Finance Industry.

FinTech is also active in cryptocurrency, smart contracts, Automation (buyers and sellers), and Robotic Investment advisors.

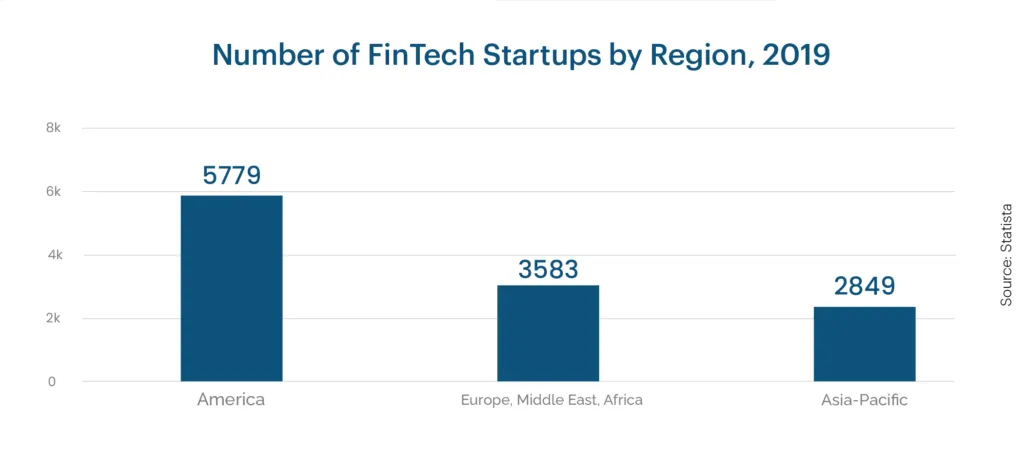

Below are some FinTech stats to look out for:

This is making the world go digital in finance, where your money can be exchanged online, stock markets are accessible at your fingertips, and investments can be made with direct interaction.

Let's get started -

Fintech has been a critical game-changer for entrepreneurs, making it easier for startups and minor businesses to process payments, secure loans, manage the workforce, track expenses & monitor cash flow, & a lot more.

Small & Medium businesses need loans to start, operate, or expand. A few years ago, a lot of structural issues caused difficulties in dealing with traditional financial institutions to get a personal/business loan, such as numerous visits to the Bank & the requirement of an endless list of documents with high turnaround time.

If you are an entrepreneur & have applied for a loan before the rise of FinTech, you would understand this situation like no one else.

But THANKS to Fintech; the entire process has been transformed by ending the struggles entrepreneurs and small businesses have faced for a long time.

Tech innovations in finance have made the loan processes online, paperless & convenient by bridging the gap between financial institutions & businesses/customers. You can now initiate the loan application & submit documents online with your smartphone or laptop. These streamlined operations in the Finance industry can help you get a loan within a week or sometimes even faster. In 2017, online lenders (FinTechs) were the 3rd largest Source of SME funding in the United States, accounting for 24% of all business lending.

A Glimpse of PayPal's Latest Milestone in Small Business Loans:

In May 2019, the global FinTech leader Paypal announced it had provided more than $10 billion in loans to over 225,000 small businesses around the globe. "It took PayPal twenty-three months to get to the first $1 billion in lending, and now we're hitting more than $1 billion per quarter," said Darrell Esch, vice president of global credit at PayPal.

FinTech has changed the way payments are processed between customers & merchants. It has evolved from Debit/Credit Cards to Mobile Wallet Solutions & Unified Payments Interface (UPI) - providing a lot of convenience to both the customers & businesses to transact. Accepting payments via credit/debit cards is still an excellent option to process payments digitally, but for small merchants, purchasing machines to accept payments via cards is only sometimes an optimal solution.

This is where mobile payment solutions came as a boon for them - allowing them to accept payments alternative to cards by sharing a QR Code or Mobile Number. Because of the convenience & ease of transacting via mobile - Mobile Wallet Solutions & Unified Payments Interface (UPI) dominated the Indian market; below are some stats that might excite you -

Paytm, PhonePe & Google Pay are some popular mobile wallets & payment processing apps in the Indian Market commonly available & accessible at Tea/Tobacco Shops & Other Small Vendors Across Streets in India.

To thrive & succeed in business, you need to keep a sharp eye on the business cash flows - payrolls, taxes, expenses, contract payments, deductions & more. Therefore, it is vital to have a streamlined accounting process to monitor these cash flows in real-time to smoothen business operations further. Years ago, small business owners that could not afford to hire accountants used to take this responsibility on their shoulders -ending up facing issues and investing a lot of time. But with technology innovations, many FinTech companies have introduced accounting apps (expense tracking, invoicing, etc.) that are free to use.

Business Owners don't need to have IT Skills or Accounting Knowledge to operate this software - creating a lot of ease for them to track expenses by saving time & effort without spending money.

The Global Financial Crisis of 2007-2008 gave birth to Technological innovations in Finance Industry. As the consequences of this crisis started to emerge - people lost their jobs & families lost their homes. But most importantly - people began losing their trust in the financial institutions meant to offer them financial support.

This led to the rise of companies that innovated technologies, slowly disrupting the financial services industry. The Financial Services ecosystem is still in a state of transformation. New FinTech startups are entering the marketplace regularly while Established Financial Institutions ( Branded Banks) are investing significantly to keep up with the latest digital offerings & capabilities.

Let's have a look at the beneficiary attributes offered by new FinTech Startups:

But despite the technological innovations, these FinTech companies could not replace traditional Banks (branded & trusted financial institutions) because consumers feel comfortable keeping their money & maintain their long-relationships with a bank. Initially, the Banks were slow in driving technological changes due to the legacy of organizational and cultural hierarchies. But now, they are more attentive than ever.

Some Beneficiary Attributed Offered by Branded & Trusted Banks

The most common reason people don't use payment solutions by FinTech Startups is concern over security standards. These digital payment-processing companies have to invest in patching up security holes and show consumers the suitability of their services, balancing everything else. Implementing this would help in expanding their footprints across markets.

FinTech Companies will continue to disrupt the industry, and these Established Institutions don't like to be disrupted.

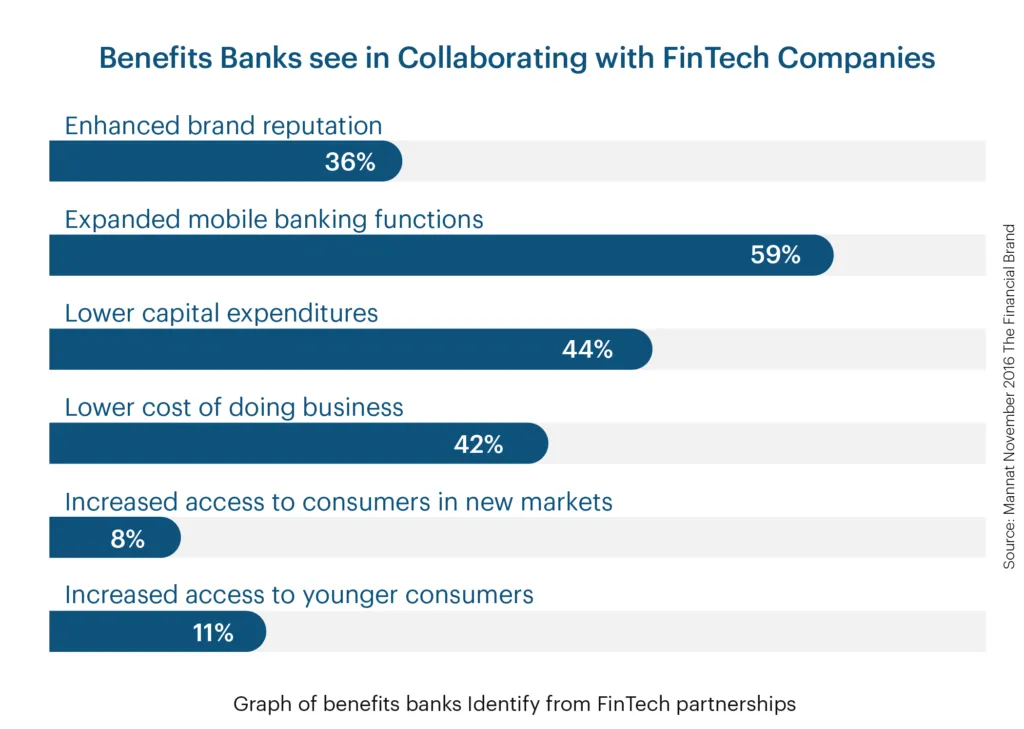

This competition looks to be foreseeable, and indeed the struggle for market shares often leads them to clash with each other. However, In recent times, conventional banks and FinTech companies have been looking forward to collaborating instead of reinventing FinTech because now they understand that collaboration may be the best road to long-term success in their industry.

In 2017, 88% of incumbent financial institutions feared losing money to the disruptive innovation of fintech companies, but 82% plan to partner with fintech startups in the next 3–5 years. Source

In 2018, almost 70 percent of senior banking executives said that teaming up with fintech and Bigtechs to create a new service was a significant opportunity for banks.MasterCard is one such project that supports entrepreneurs to start their projects in domains like banking, AI, security, and logistics by giving them access to the MasterCard ecosystem. This partnership helps them bring together services to the customers that are more convenient by offering customers an optimized experience and security in Financial transactions.

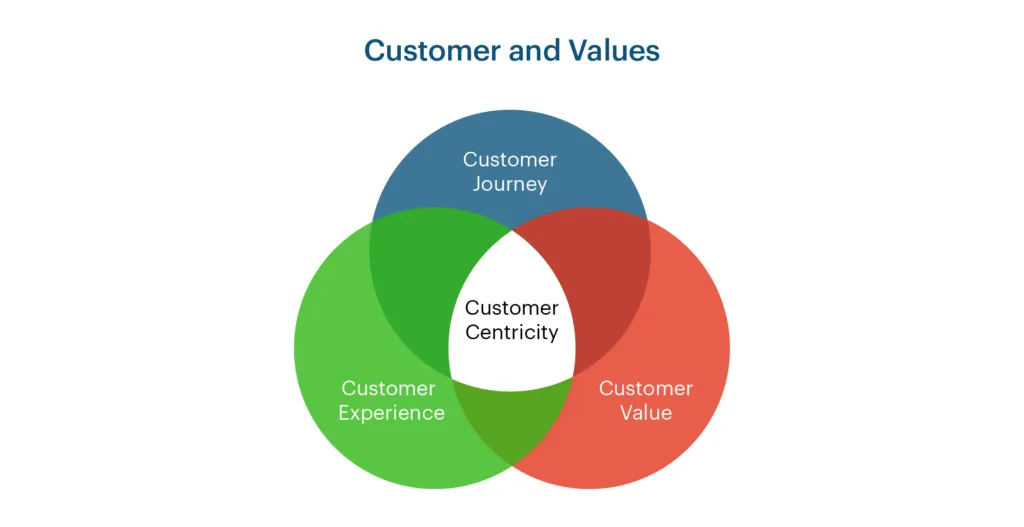

Over the past years, Tech innovations have made us all adapt to customer-centric solutions - built with the consumers' needs in mindThis change in consumer behavior is the most significant trend that gave rise to the rapid growth of Innovations with the Customer-Centric approach.

To remain competitive & relevant in the market today, adopting this approach has become crucial. So the key players in the Finance Industry are now working on implementing stable and scalable technologies to create a smooth experience for customers - engaging with them in a better-personalized way -at the right place & time. Or say, Moving From Product-Centric to Customer-Centric.

FinTech is intensely adapting automated customer service technology - utilizing AI & NLP powered chatbots to support customers with a better- personalized experience & their basic queries and keeping down the staffing costs. These Chatbots are improving the digital customer experience for banking, insurance, investment, wealth management & more. Below are some of the critical features of an advanced AI & NLP Powered Chatbot for the Finance Industry

Chatbots and numerous AI & NLP backed Industry Leaders are implementing innovations to offer improved customer experience in the Finance Industry. Processing data using NLP & AI can create a more diverse, stable & streamlined banking landscape soon.

FinTech is expanding its impact and marking its presence in the digital world exponentially. It's time we adapt to the contemporary ways of business. Technology will continue to dominate & bring a high degree of change to nearly every area of our life by transforming perspectives towards the traditional approach. You can't ignore the rise of EdTech & how everyone is adapting to the tech transformations in the Education industry. The traditional teaching approach & 4-walled classroom-only system is getting near extinction. Similarly, the Finance Industry is no exception.

We will be your great partner if you are also looking to tap into the FinTech market. As a leading mobile & web app development company , we have developed numerous Technology Solutions for our clients across the globe.

Let us translate your idea to transform Financial Services into a reality - Call/Whatsapp +91-9501620330 or send an email to letstalk@quokkalabs.com

Top React Native Development Companies to Build Scalable Apps

By Dhruv Joshi

5 min read

How Wearable Technology Is Driving Real-Time Data Experiences in Mobile Apps

By Sannidhya Sharma

5 min read

How to Use Augmented Reality in Retail to Boost Customer Engagement and Sales

By Sannidhya Sharma

5 min read

How to Use Augmented Reality in Accounting to Build Smarter Financial Apps

By Dhruv Joshi

5 min read

Industry news

5 min

Did you know that by end of 2025, over 60% of educational apps will be powered by AI? Software within the education industry continuously adopting AI technology —it’s reshaping how students learn, engage, and succeed today. In this blog, we’ll dive into how AI is transforming education through smarter, personalized learning experiences. From cutting-edge educational app development to real-world examples, updated stats, and expert insights, you’ll discover why AI isn’t just enhancing education—it’s defining the future of smart learning.

Industry news

8 min

Choosing the right mobile app development company is crucial to the success of your project. Whether you're looking for a partner to bring your idea to life or enhance your existing app, the companies listed here have the expertise and experience to deliver exceptional digital solutions. With their proven track record and commitment to excellence, you can trust them to take your mobile app projects to the next level.

Industry news

5 min

Dive into the future of latest healthcare trends of 2024. From AI diagnostics to telehealth and wearables, discover how innovation is reshaping patient care. Join us in coding the future of healthcare.

Feeling lost!! Book a slot and get answers to all your industry-relevant doubts