In blockchain technology, the world has been coming long. While many attempts to create a decentralized and trustless system, none have succeeded. Solana and Ethereum are two projects that aim to bring down the chaos of the current blockchain ecosystem by providing stability, safety, and scalability.

In this post, we'll look at key differences between these two platforms so you can decide which might suit your projects!

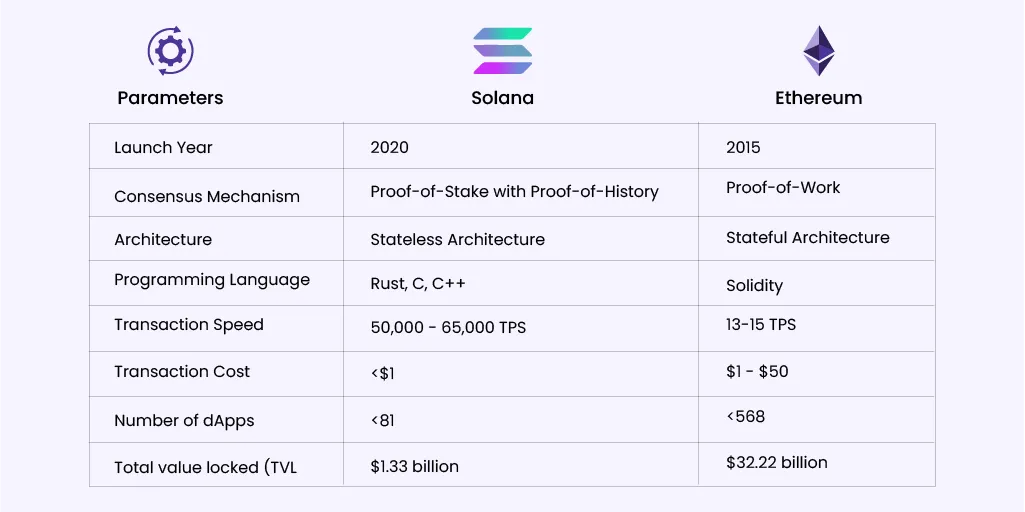

A Quick Comparison

Let's look at the key difference between Solana and Ethereum. You'll see that they have different goals, but they're both focused on being fast and scalable.

Solana is a fast, scalable blockchain that supports high-volume applications. It aims to provide a foundation for decentralized computing, while Ethereum has been focused on providing a platform for smart contracts and other decentralized apps.

Solana is an entirely different type of blockchain technology than Ethereum. Where Solana is focused on scalability, Ethereum is focused on decentralization.

Solana was developed by an ex-Ethereum engineer, Jae Kwon, and a team of other experts in the industry.

Ethereum was designed by Vitalik Buterin in 2013 and has been used by large corporations like Mastercard (Masterpass) and Microsoft Azure since then.

Solana has several advantages over Ethereum, such as higher scalability,

better security of data, faster speed in processing transactions, and cheaper fees for executing smart contracts. It is a new DLT that uses Proof of History to store data transactions.

Solana and Ethereum are both DLTs. It is a new project that aims to implement distributed data storage with Proof of History. While Ethereum is one of the most popular DLTs, it stores data on a blockchain that has been proven to handle some severe loads.

What is Ethereum?

The first programmable blockchain is Ethereum, which gives programmers access to a feature called general-purpose smart contacts that they can use to create decentralized applications.

Decentralized finance (Defi) apps and non-fungible tokens (NFTs) can be used with the Ethereum blockchain. Ethereum was designed to be everything to everyone with a wide range of specialized applications. And that's exactly what it accomplishes. It provides security and a complete set of resources for creating any decentralized application.

Ether (ETH) is the blockchain's native asset, which covers transactions' gas costs. But Ethereum is currently transitioning to proof-of-stake (PoS), which will have several advantages for the network, including lower costs.

What is Solana?

A high-performance decentralized blockchain called Solana was created to support the scaling of user-friendly applications. Solana is home to thousands of projects in Defi, NFTs, Web3, and other areas, and one of the fattest-expanding ecosystems in the world.

The Solana blockchain is renowned for its speedy and affordable transactions. Because of Solana's scalability, all transactions are guaranteed to cost less than $0.01, and blocks of transactions can be done in as little as 400 milliseconds.

Of course, there are flaws in the Solana blockchain as well. The Solana

network experienced three outages in September 2021, one of which left the entire network inaccessible for nearly 17 hours. More recently, a Solana bridge connecting to the Ethernet network was also compromised, with $320 million in funds being taken.

Solana vs. Ethereum— Quick Comparison

Solana vs. Ethereum Comparison Based on Features

The two blockchains of Ethereum and Solana significantly differ in

decentralization, transaction speed, transaction cost, and popularity- all

elements crucial for dApps developers and end users due to consensus mechanism and architecture differences.

1. More Decentralized

There is a hierarchy upon which most blockchain sits; some blockchains are frequently more centralized than others. The number of entities that make up the network's total hash rate determines how decentralized Proof-of-Work blockchains like Ethereum can be. The network will become more centralized if a small number of minors contribute a significant portion of the hash rate.

On the other hand, the distribution of staked coins among all validators in the network determines how decentralized a PoS blockchain like Solana is. The network will become more centralized if a small group of validators controls a significant portion of staked coins.

According to a report by Blockworks, there were 6,373 nodes and a total hash rate for Ethereum of 1 petahashes per second in March 2022. The top 3 Ethereum mining pools contributed 60% of the total hash rate.

The whole number of validators in the Solana blockchain was 1,576 in March 2022. Those 1,576 validators staked over 75% of the circulating supply of SOL. Despite the high percentage of staked tokens, it's essential to remember that 48% of all SOL tokens were initially distributed to internal Solana project participants.

2. Faster to Send

Solana is one of the speediest cryptocurrencies on the blockchain, despite being less decentralized than Ethereum in terms of transaction speed. Although Ethereum has dominated the development of decentralized applications (dApps) to date and may provide a higher level of security, developers who need scalability, such as those looking to disrupt the established financial and gaming industries can benefit from the Solana blockchain's faster transaction times.

The number of transactions a blockchain can process per second is how

transaction speed is typically measured. The Ethereum blockchain is the

slowest in terms of transaction speeds. Ethereum can process 13–15

transactions per second (TPS) thanks to its stateful architecture and PoW

consensus mechanism. Despite having a 15 TPS transaction rate, the network's abundance of dApps causes frequent transactions to take much longer.

In contrast, Solana's transaction processing times only take a few seconds. Solana can process 50,000–65,000 TPS at most using the blockchain's hybrid PoS–PoH consensus mechanism. Although the blockchain can process 65,000 TPS, the actual transaction speed is much lower because there are currently fewer dApps on the network.

The new PoS consensus layer will enable the blockchain to process

25,000–100,000 TPS after the impending Merge, according to Ethereum

developers. This, however, is still up in the air.

Read More- What Happened in Ethereum Merge?

3. Cheaper Transaction Fees

The underlying technology of the two blockchain networks leads to a stark contrast in transaction times and significantly different gas fees. The price of ETH has historically been volatile because of the Ethereum network's high user density and congestion. The network's transaction fees are still significantly higher than most other networks, even though some gas fee spikes can be attributed to the rising value of native ETH coins. Prices have in the past gone over $60 for a single transaction.

The blockchain's base fee was stabilized in 2021 following an upgrade, which was done to counteract rising costs. However, gas prices on the network are still too high to match those in Solana.

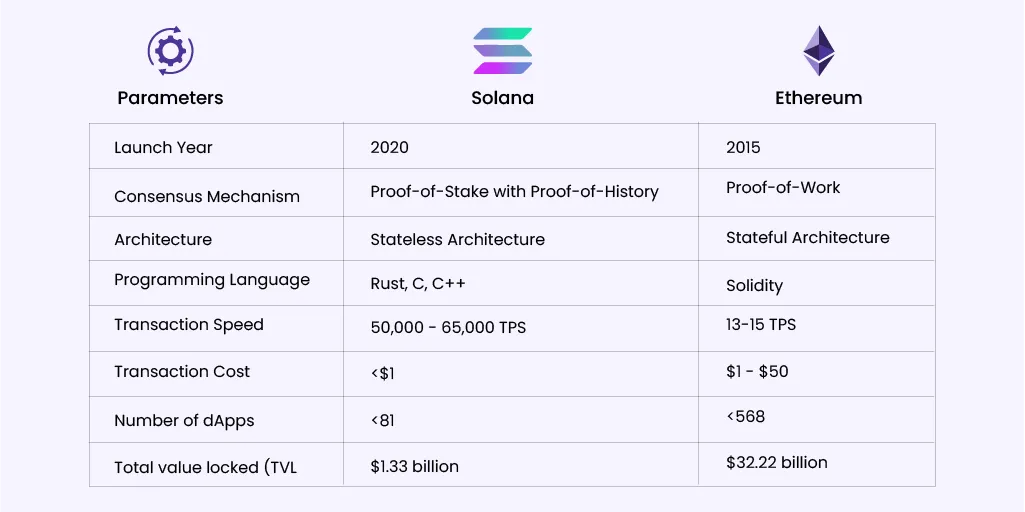

4. Popular Network

The number of deployed decentralized applications and the total value locked (TVL) is two valuable metrics to examine when comparing the popularity of the blockchains. It can be assumed that the cryptocurrency community does not support a blockchain if end users deploy dApps and TVL is low.

Second, it's essential to remember that Ethereum has a five-year advantage when comparing Ethereum and Solana. Until January 2021, over 95% of the total value locked (TVL) in dApps was in Ethereum. Only starting in 2021 did the market share begin to decline.

DeFiLlama, a decentralized finance

aggregator, reports that Ethereum holds the top position. There are 563

protocols active on the Ethereum blockchain, with a TVL of more than $32.22 billion. Solana, in contrast, is home to 81 protocols and has a TVL of $1.33 billion.

Summary of Key Differences Between Solana and Ethereum

The key difference between Solana and Ethereum is that Solana has a new consensus algorithm. The Proof-of-Stake consensus algorithm used in Solana is called SOLA, which stands for Solve. In simpler terms, this means that the network will use its computational power to check whether transactions are valid or not. This process is referred to as Proof-of-Stake.

Ethereum uses the proof-of-work (PoW) algorithm with its Casper FFG protocol and sharding framework that aims to improve scalability through parallel processing across different nodes within the network while making it more energy efficient than PoW chains like Bitcoin or Litecoin.

Final TakeAway on Solana vs. Ethereum

These two cryptocurrencies or platforms are very different, and they have their strengths and weaknesses. Solana aims to achieve the best of both worlds by combining the security of Ethereum's Proof-of-Work consensus mechanism with the scalability of smart contracts.

On the other hand, Ethereum offers more flexibility and freedom when writing smart contracts. However, its relative newness means that there may be some growing pains associated with it until developers get used to this new way of doing things.

Tags

blockchain development service

comparison guide

ethereum

solana

solana vs ethereum

Facebook

Facebook

Twitter

Twitter

LinkedIn

LinkedIn

Pinterest

Pinterest